[ad_1]

Premier Danielle Smith suggests her government is willing to consider provincial assistance to kickstart investment in carbon capture and storage developments, including the mega-project being considered by the country’s largest oilsands producers.

It’s a different message than the one delivered by her predecessor, Jason Kenney, as billions of dollars in proposed investments in carbon capture, utilization and storage (CCUS) projects are awaiting final approval.

In an interview, Smith said she’s heard that Ottawa wants a partner “if we’re going to offer tax credits and tax incentives” for such developments.

The premier has asked Alberta Environment Minister Sonya Savage to talk with federal officials “to see what we might do to create an environment that would allow for us to attract that investment.”

Earlier this year, the Trudeau government introduced an investment tax credit for CCUS developments worth up to 50 per cent for spending on equipment to capture CO2.

However, this measure now lags behind more lucrative incentives made available through the U.S. Inflation Reduction Act, which was signed by President Joe Biden in August.

Asked if the province is willing to provide any direct assistance to attract investment from the Pathways Alliance — a group of six large oilsands producers — and other CCUS project proponents, Smith indicated the door is open for talks with Ottawa.

“I’m very conscious of the fact that in the U.S. the measures being proposed by Biden are some of the best in the world for business attraction — same with Norway. And I would hope that we could try to be comparable,” she said.

“Our approach in Canada has been all stick. It’s been all costs and taxes and punitive measures. It’d be nice if we could offer some carrots of tax incentives.

“And so, I’m prepared to have that conversation and I know that my environment ministry has reached out and we’ll see if we get a positive response from the federal government.”

Officials with federal Environment Minister Steven Guilbeault did not reply Monday to questions about such discussions.

But Pathways Alliance vice-president Mark Cameron called Smith’s remarks encouraging.

“I certainly get a sense from the premier’s (comments) that she’s open to looking at new ideas,” Cameron said Monday.

“I think there is probably a willingness to put more on the table, which we really welcome.”

Recommended from Editorial

-

‘Canada will get left behind’: U.S. incentives for carbon capture could lure investment south

-

Varcoe: As Trudeau trades jabs with province, clock ticks on carbon capture projects worth billions

-

Alberta’s UCP government ‘pleased’ with federal budget’s carbon capture tax credit

Several large carbon capture projects have been proposed in the province over the past two years, although final investment decisions have yet to be made, including on a CCUS initiative pitched by the Pathways Alliance.

The group of oilsands producers— including Suncor Energy, Canadian Natural Resources and Cenovus Energy — is working together to reach the target of net-zero emissions by 2050.

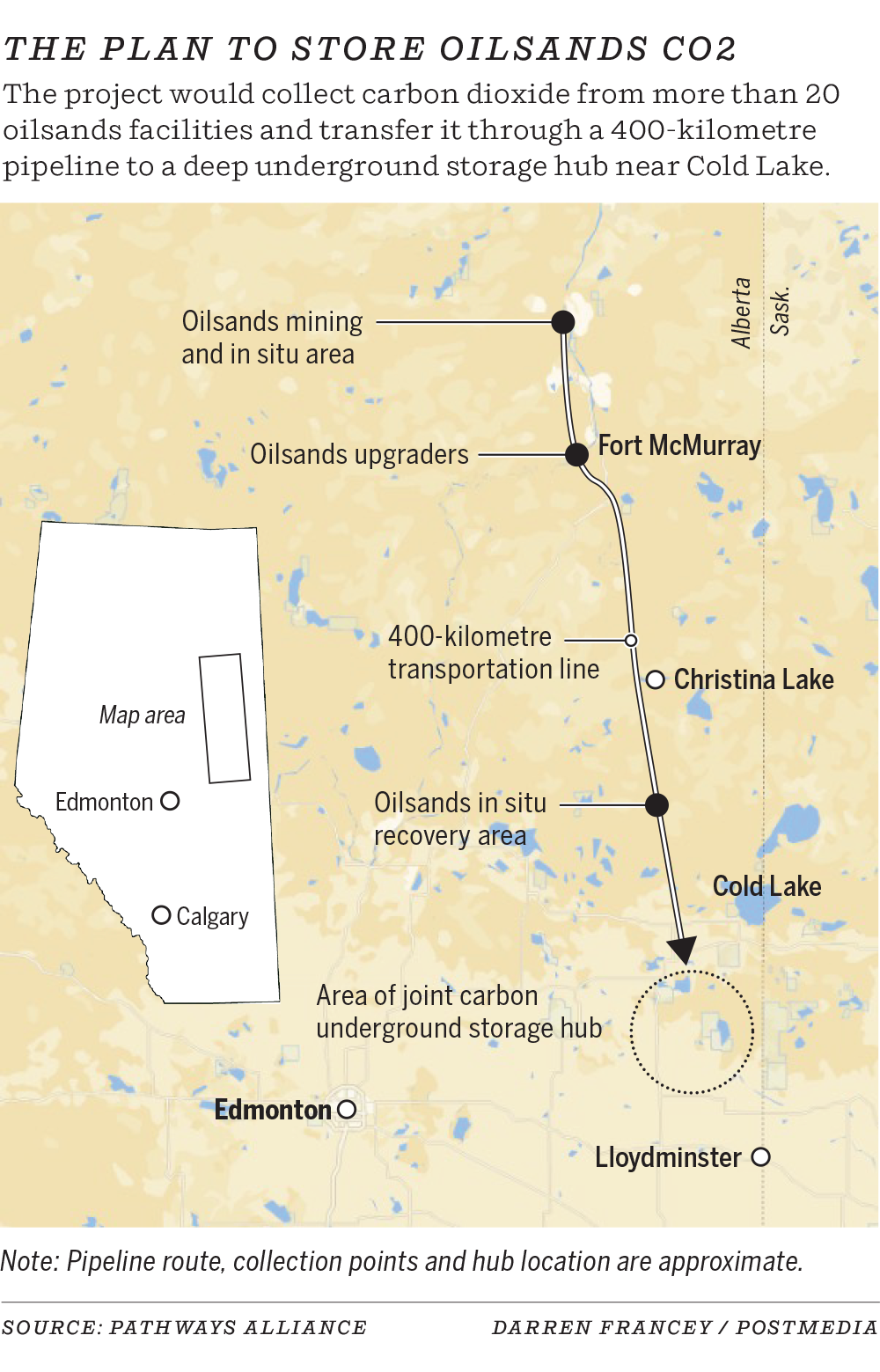

The alliance’s plan to cut its emissions includes a $16.5-billion carbon capture and storage network in Alberta. It would build a CO2 transportation line connecting oilsands facilities in the Fort McMurray area to an underground storage hub near Cold Lake.

However, such projects are expensive and the economics are tricky.

Oilsands executives welcomed the federal investment credit, but say they’re also looking for provincial assistance, noting the U.S. recently bolstered its own existing tax credit for such facilities to $85 for each tonne of stored CO2, up from $50.

As premier, Kenney rejected the notion of offering direct assistance to oilsands operators.

He pointed out the province will provide a multibillion-dollar contribution to the Pathways project because oilsands companies can deduct capital expenditures on their CCUS projects from the royalties paid to government coffers.

“These are companies that are hugely profitable. If they believe that these kinds of investments are critical for their long-term future, I’m sure they can find a way to make it work,” Kenney said in an interview in May.

Alberta’s new premier views the issue differently.

“Allowing a company to keep more of what they earn, so that they can put it into long-term emissions reduction, that benefits all of us,” Smith said.

“I’m not a huge fan of taking dollars out of the treasury and doing direct grants. But having a broad-based tax incentive that allows anybody who’s taking these measures, to be able to keep more of what they earn, I think that’s a positive way of going about it.

“So that’s the kind of thing I’d be interested in having a look at.”

Industry groups, including the Calgary Chamber of Commerce, have called for the province to extend incentives to such projects, maintaining it would unlock capital and secure jobs in Canada.

However, the issue is divisive.

While the Pembina Institute supports the federal CCUS tax credit, it has opposed providing more incentives.

“At this point, we don’t see the justification for more, beyond what’s been announced,” said Pembina Institute senior adviser Scott MacDougall.

The province’s environment minister said work is being done to understand what is needed to get carbon capture projects moving across all sectors.

Savage said the province is analyzing how various programs stack up together, such as the investment tax credit, offsets, provincial royalties, a federal contract-for-differences to guarantee the long-term price of carbon, and other measures.

“We need to be able to be competitive and match what they’re doing in the United States and that’s probably going to mean the federal government has to sweeten the pot,” Savage said Monday.

“It means we have to be open to looking at what other areas in Alberta might need to be to be considered.”

Savage said nothing is on or off the table at this stage and rejected the idea this is a change in approach by the UCP government, calling it a prioritization of the file.

Whatever it is, the change in tone was welcomed by industry.

“I find it very encouraging that the provincial government wants to have a discussion with Ottawa about what kinds of measures might be necessary to create incentives to attract CCUS investment to Canada,” Cameron said.

“That’s a really positive message.”

Chris Varcoe is a Calgary Herald columnist.

[ad_2]

You can read more of the news on source