It’s taken the return of US$100-a-barrel oil and a call from North American governments for increased energy production, but Canadian oil and gas leaders are growing more confident that higher prices are here to stay this year.

With oil and natural gas markets strengthening, two new surveys of industry executives show Canadian companies believe robust conditions will prevail throughout 2022.

A survey by Raymond James of 56 petroleum producer executives this month asked where they expect oil prices to be in a year’s time. The average price outlook for benchmark West Texas Intermediate (WTI) crude was $96.40 a barrel, just above Monday’s level.

While U.S. natural gas prices are expected to soften to $4.40 per thousand cubic feet a year from now, those prices are still relatively strong.

Asked what they will do with any unexpected free cash flow coming from high commodity prices, eight in 10 producers said they will increase spending on buying back shares. Almost three-quarters will look at debt repayment, while 71 per cent anticipate increasing their capital spending, up sharply from levels reported last October.

“Executives believe these higher oil prices are likely to be around for at least another year,” said Raymond James analyst Jeremy McCrea.

“You can definitely see there is a little bit more comfort, a few guys going out more on a limb here saying, ‘It’s OK to grow.’”

If higher energy prices hold, McCrea believes many management teams will consider expanding their capital programs for the fourth quarter of the year.

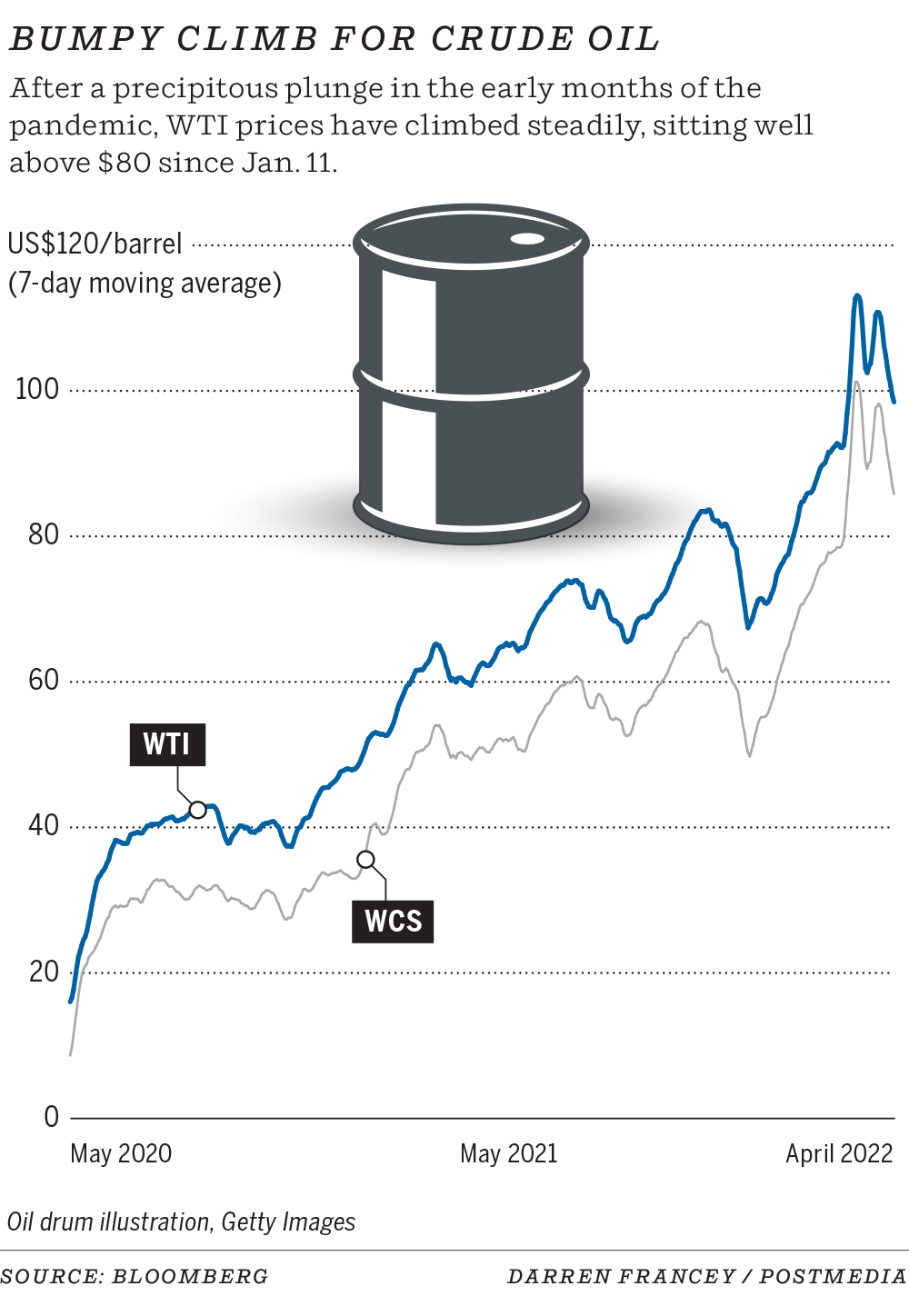

Petroleum producers across North America have been reluctant to significantly increase expenditures to boost output since the collapse of energy prices two years ago at the beginning of the pandemic.

Investors have been calling for the return of excess cash flow to shareholders in the form of higher dividends and buybacks. Last month, the Trudeau government and Biden administration asked producers to raise output to help western allies shift off of Russian energy.

Oil prices, which sat below $60 a barrel in August, surged near $120 a barrel last month following the invasion of Ukraine by Russia, one of the world’s largest oil exporters.

Benchmark prices have since fallen, closing Monday at $94.29 a barrel as pandemic-related lockdowns in China are expected to crimp global demand.

A separate survey by ATB Capital Markets of 103 executives with Canadian petroleum producers, service firms and institutional investors last month found the energy sector is gaining momentum.

While many respondents anticipate energy markets will decrease over the year, more than half believe oil prices will remain above US$75 a barrel for the next three to five years, a profitable level for the sector.

It also found 89 per cent of producers expect a stronger outlook for their company over the next six months — not one said they believe things will get worse — while 91 per cent of oilfield services firms anticipate increased levels of industry activity over the same period.

“People are starting to buy into a longer-term, higher commodity price expectation. And for service companies, we’re seeing the market is really tightening,” said analyst Tim Monachello of ATB Capital Markets.

“It really feels like this rally has some legs, probably multi-year in nature.”

The poll also found more capital spending is likely this year, with two-thirds of producers planning to boost their budgets by double-digit levels over 2021.

Six in 10 service firms expect customer activity to increase this year as a result of the Russian invasion of Ukraine, the survey also found.

Respondents said cost inflation and increased prices for oilfield services are leading to higher drilling costs this year; labour market tightness and supply chain issues are limiting capacity.

On the jobs front, 86 per cent of energy services executives expect a higher headcount at their company in the next six months, while 43 per cent of exploration and production firms anticipate adding staff.

Headwater Exploration president Jason Jaskela said many currents are swirling around oil energy markets today, including the invasion of Ukraine, the release of volumes from strategic petroleum reserves in consuming countries, and new COVID-19 public health restrictions in China.

However, producers largely have debt levels under control and supply-demand fundamentals remain strong, allowing companies to consider more spending to boost production.

“There’s just so much volatility in the price of oil and it’s a challenge to forecast, but as an industry, we believe that there is optimism in future pricing … and that $85 to $95 range feels right,” Jaskela said.

“As an industry, as producers, we’re back in the driver’s seat and have a bunch of options to choose from.”

While oil producers have recently seen the strongest prices since 2014, the outlook for natural gas is also robust as the U.S. is exporting more liquefied natural gas (LNG).

The price for benchmark U.S. gas closed Monday at US$6.64 per million British thermal units (mmBTU), and gas futures are up more than 70 per cent since the start of January.

Lower storage levels for gas in Canada, the United States and Europe indicate “we’ve got a pretty good runaway ahead of us,” said Phil Hodge, CEO of Calgary-based Pine Cliff Energy.

“Natural gas seems to be coming into a new era of recognition of how important it is to energy security and energy use,” Hodge said.

“This is probably the most optimistic we have been in several years, it’s safe to say.”

Chris Varcoe is a Calgary Herald columnist.

You can read more of the news on source