Alberta’s premier was surprised by Joe Biden’s shift last year to oppose the Keystone XL pipeline, but says the project’s fate is “not over yet.”

Jason Kenney is disappointed Canada’s top court has backed the federal carbon tax and says he’s now considering Alberta’s options, including a cap-and-trade plan with other provinces.

And the UCP leader believes pipeline giant Enbridge has an “air-tight case” in its dispute with Michigan over Line 5, noting there’s strong federal support for it — unlike Ottawa’s “abject surrender” on Keystone XL.

In less than an hour on Friday, Alberta’s premier mowed through a field of thorny energy issues while speaking to the country’s oil and gas drillers.

Underpinning it all, Kenney attempted to convey a level of confidence that didn’t exist a year ago when the industry, along with the province, were in freefall.

“Just think about how far we’ve come in the past year. I felt like I was looking into the abyss,” Kenney told the online annual meeting of the Canadian Association of Oilwell Drilling Contractors.

“We were planning for the most extreme scenarios, truly. And thank God we recovered more quickly.”

CARBON TAX RULING

The biggest news for Kenney’s government this week came from a

landmark Supreme Court of Canada decision that the federal carbon price legislation is constitutional

.

The court rejected a bid by Alberta, Saskatchewan and Ontario to strike down the national carbon price plan.

The province must now decide if it will retain the federal backstop program or look at other options.

The alternatives include reintroducing a made-in-Alberta consumer tax, broadening the province’s existing carbon levy on large industrial emitters or joining a cap-and-trade program, similar to one Quebec is now in.

“We are going to talk with other provinces to see if there is a broader interest in that, so we’re not captive to the California market like Quebec currently is,” he said.

KEYSTONE XL

The premier also defended his government’s ill-fated decision last spring to invest $1.5 billion into TC Energy’s Keystone XL project, as well as provide up to $6 billion in loan guarantees.

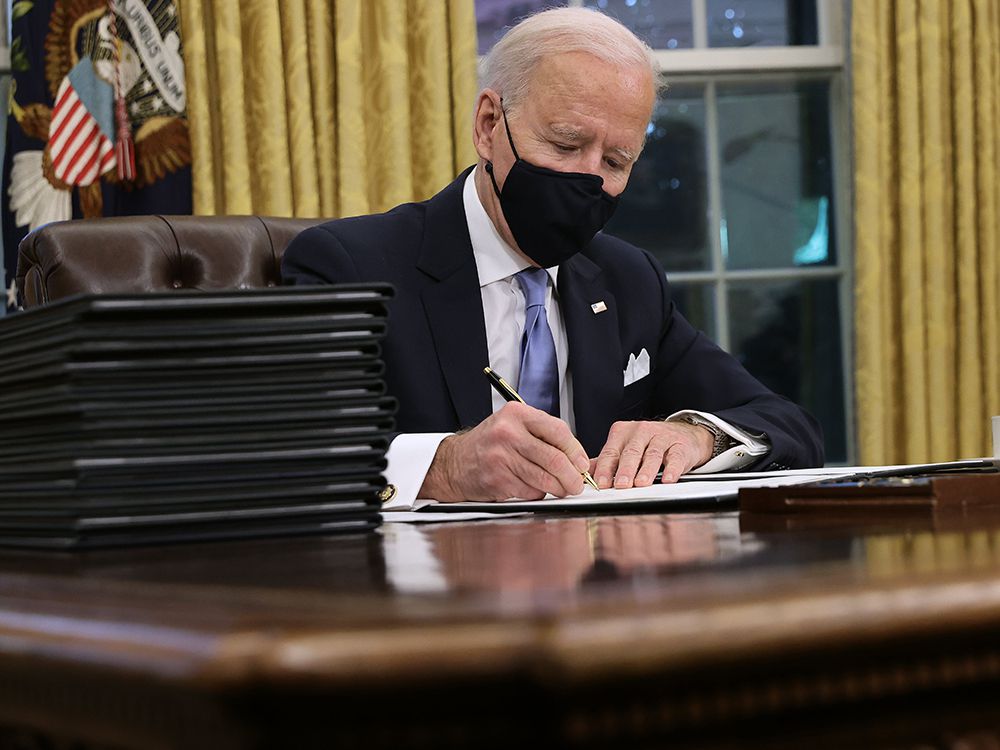

In January, just hours after becoming president, Biden cancelled the necessary permits for the cross-border oil pipeline, halting construction.

When Alberta announced its investment last March, Biden was the only major Democratic presidential candidate who hadn’t signed a pledge to stop the project on climate grounds.

Several weeks after the province’s announcement, the former vice-president declared he would block the line if he won the November U.S. election.

“We were frankly surprised when he suddenly moved to the left after having won the primaries,” Kenney told the audience.

“We may be able to make some use out of those assets. It’s not over yet. We are trying to figure out the future of that with TC Energy. And if we decide to abandon the project, we will certainly be seeking damages.”

The province has pegged its financial exposure from the project at almost $1.3 billion.

LINE 3 and LINE 5

Kenney said he expected the Trudeau government to put up more of a fight with the U.S. over Keystone XL once it was vetoed and pointed out the feds have demonstrated far more resistance over an existing oil pipeline: Line 5.

Michigan Gov. Gretchen Whitmer is seeking to block Enbridge’s pipeline to Central Canada, citing environmental and safety concerns.

Line 5 moves 540,000 barrels per day of oil and natural gas liquids from Alberta to Central Canada, with the pipeline running under the Straits of Mackinac, shipping product across Michigan to southern Ontario.

The pipeline is critically important to supplying refineries in Quebec and Ontario, as well as providing fuel to Michigan and other states in the region.

Whitmer served notice last year that by May, the state would revoke an easement dating back more than six decades that allows Line 5 to cross under the Straits of Mackinac.

A legal showdown is looming. Enbridge has said the line complies with U.S. safety standards and Michigan lacks the authority to shut it down.

“We think Enbridge has an air-tight case in court,” Kenney said.

More broadly, the premier is optimistic about pipeline access improving out of Western Canada. Enbridge’s Line 3 replacement pipeline, running from Alberta to Superior, Wis., is expected to be finished later this year, while construction on the Trans Mountain expansion continues.

Asked about Ottawa’s response on Line 5 — the Trudeau government is making it a priority to keep the pipeline operating — Kenney compared it to the federal efforts surrounding Keystone XL, which he described as an “abject surrender.”

“The reason they are taking a different approach to Line 5 is because it affects Central Canada,” he added.

“So what can I say? Classic Ottawa politics.”

New Energy

The premier also spoke about the future of energy transition, ESG considerations and new opportunities to develop carbon capture and storage technology.

There is also potential for Alberta to expand its emerging energy sources, such as developing geothermal and hydrogen, which is part of the province’s broader natural gas strategy.

“We are in advanced discussions with a major investor looking at a $3 billion investment in that,” Kenney said, without offering further details.

All of these comments strive to paint a picture of enthusiasm building in the industry, particularly as commodity prices strengthen.

CAODC president Mark Scholz said he hasn’t felt this positive about the industry’s prospects for a long time, noting Canada’s energy industry is at a crossroads.

The association, established 72 years ago, is even exploring a change to its name.

“We are doing that to better position the organization and its members, as the industry navigates through rapid transformation,” Scholz said.

While the sector evolves, it still faces a myriad of challenges, such as public pressure to decarbonize and ongoing difficulty to attract capital.

Companies are coming off a long, gruelling period, beginning with the oil-price collapse in 2014-15 and now the impact of the pandemic.

Yet, there is growing confidence, something sorely lacking a year ago.

“There is a lot to be optimistic about. The pipelines appear to be inching forward and production has rebounded,” said Kevin Birn, chief analyst of Canadian oil markets for consultancy IHS Markit.

“But nothing is guaranteed.”

Chris Varcoe is a Calgary Herald columnist.

You can read more of the news on source