[ad_1]

It doesn’t take a lot of imagination to envision what a two-year delay to the Trans Mountain pipeline expansion could mean to the province of Alberta or the Canadian oil sector.

In the view of Alberta’s premier, it would be bad news.

“Very concerned about it, because I think there’s just so much pent-up demand” for additional pipeline capacity out of the province, Danielle Smith said in a year-end interview.

“Everybody wants this project to be done. It’s going to make such a big difference, not only to us being able to get more barrels sold, but also increasing the value of all of our barrels.”

The spectre of a potential two-year delay in getting the $30.9-billion project finished — as Trans Mountain Corp. recently warned could be a worst-case scenario — would be negative news for producers who’ve been waiting a decade to see the project built.

The Alberta government, which will benefit from increased oil production and more royalties tied to the incremental transportation capacity, would also feel the pinch.

“Getting to the finish line as quickly as possible is where we need to be,” Smith said.

“I’ll continue to cross my fingers that we get that line filled in the first quarter of next year.”

For many Albertans who thought the Trans Mountain construction story was quickly coming to an end — I lump myself in that group — that assumption may have been premature.

Is there at least one more plot twist left in this long-running saga, or only a footnote to wrap up?

The expansion of the existing 1,150-kilometre oil pipeline, which runs from the Edmonton area to the B.C. coast, has already turned into an epic slog.

The initial regulatory application to expand the existing pipeline was filed in 2013 and approved three years later.

The expansion will almost triple the pipeline’s capacity to 890,000 barrels per day, moving more crude and refined products from Alberta to an export terminal in Burnaby, B.C.

After the previous owners, Kinder Morgan Canada, appeared prepared to abandon the project, Ottawa purchased the line in 2018 for $4.4 billion.

Construction was started, halted five days later due to a court decision, then restarted. The pandemic hit, followed by flooding, soaring inflation and supply chain issues.

Since 2013, the project’s price tag has escalated 472 per cent.

Today, the expansion of the pipeline is 98 per cent complete with only about three kilometres of pipe left to install.

-

Trans Mountain project costs ’reasonably and justifiably incurred,’ company says

Trans Mountain project costs ’reasonably and justifiably incurred,’ company says -

Trans Mountain Corp. issued stop-work order for environmental non-compliance

Trans Mountain Corp. issued stop-work order for environmental non-compliance -

Trans Mountain route change will ‘desecrate’ sacred site: Secwepemc knowledge keeper

Trans Mountain route change will ‘desecrate’ sacred site: Secwepemc knowledge keeper

Trans Mountain Corp. CEO Dawn Farrell said in October she hoped to see the line being filled with oil in 2024, with the process starting at the end of January. Commercial operations were expected to begin by the end March.

Yet, there are no easy slam dunks when it comes to building major pipelines. The project is facing challenges in British Columbia because of the hardness of the rock and water inflows.

The Crown corporation applied in October to the Canada Energy Regulator (CER) for a variance related to a short 2.3-kilometre section, located along the Fraser River near Hope. It asked to install a smaller 30-inch pipe, instead of the planned 36-inch pipe, but the regulator turned it down.

Trans Mountain made a new application last week, saying that if it continues with the original plan, there is a “significant risk the borehole will become compromised.”

If the drilling fails and Trans Mountain has to implement an alternate plan, the completion schedule could be delayed.

“Such a scenario would result in incremental environmental disturbance and delay the (project) schedule by approximately two years, causing billions of dollars in losses to Trans Mountain, in addition to substantial third-party losses,” the corporation stated in its latest filing.

The interruption would lead to about $200 million a month in delayed revenues and $190 million in carrying charges, according to Trans Mountain.

Tristan Goodman, head of the Explorers and Producers Association of Canada, said a lengthy delay would likely prompt oil companies to adjust their forecasted production estimates and fiscal budgets.

“To have this happen at this point in time, to be honest, there’s no other way to describe this (than) preposterous,” Goodman said Thursday.

“We are still hopeful that it isn’t a two-year delay, but it’s quite serious.”

For producers and the province, there is a lot on the line.

An economic impact assessment conducted by Ernst & Young for Trans Mountain last year concluded that once the expansion is operating, it’s expected to contribute $9.2 billion in additional GDP across Canada over a 20-year period.

The project will generate about $40 billion of royalties and taxes to Alberta over two decades, Farrell said.

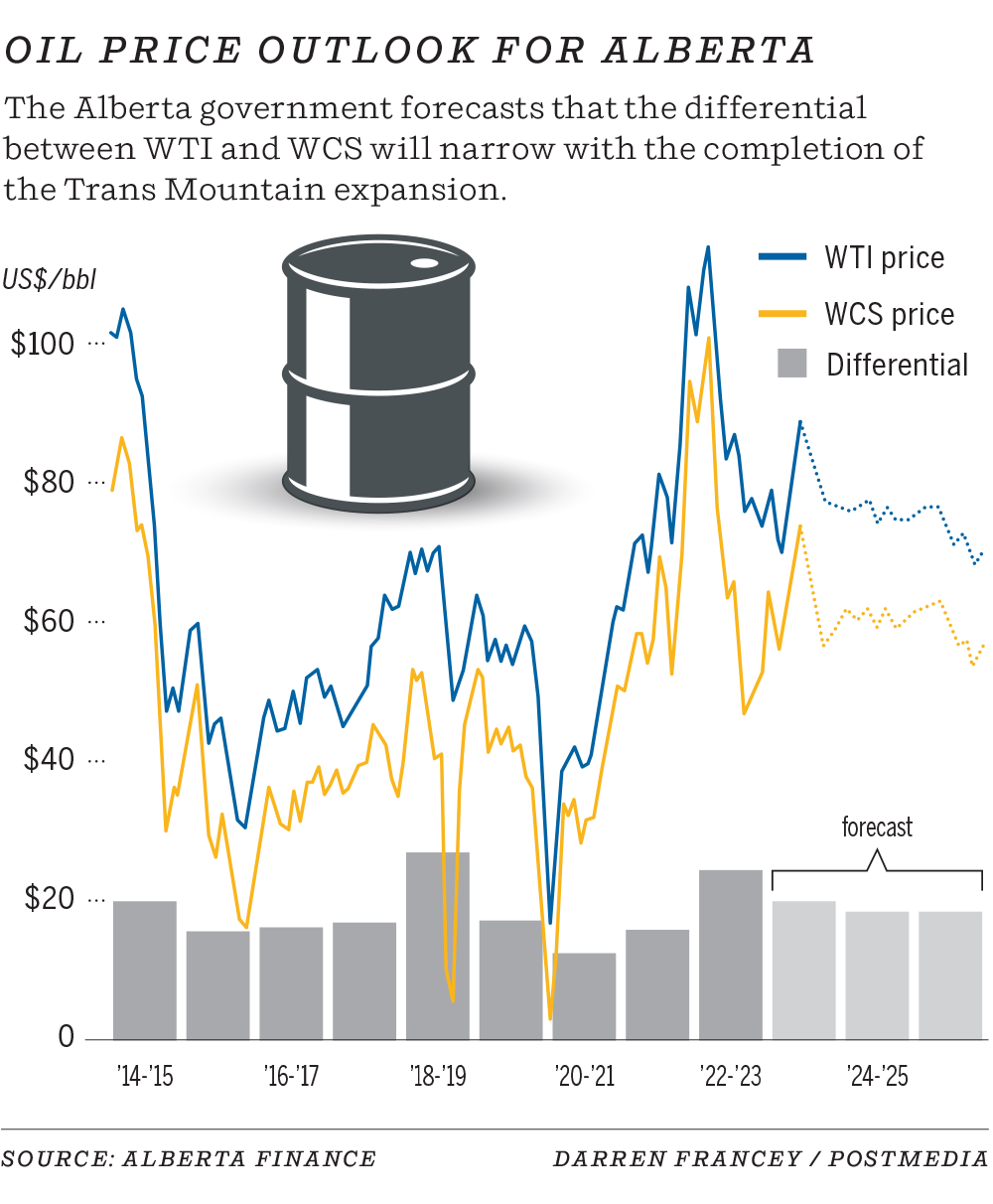

The pipeline expansion will hand Canadian producers more export capacity, and it’s forecast to shrink the price spread between U.S. benchmark West Texas Intermediate (WTI) crude and Western Canadian Select heavy oil.

The differential stood around US$20 a barrel earlier this week, according to ATB. The province’s fiscal update in November said completing Trans Mountain would help bring the discount down to around $14 to $15 a barrel in the next two years.

S&P Global Commodity Insights expects Western Canadian oil supply to increase by 230,000 barrels per day (bpd) in 2024. Peak production in late 2024-25 could top 5.2 million bpd.

“We still see the need for TMX in 2024 to be online for peak production,” said Kevin Birn, S&P’s chief analyst of Canadian oil markets.

The industry and the province will be keenly watching what the CER decides on the new application.

Trans Mountain has requested a decision by Jan. 9. On Thursday, the CER asked for additional information from the corporation.

Earlier in the week, the CER released its written reasons for the first variance application, and said Trans Mountain didn’t adequately address pipeline integrity and environmental protection concerns.

But it appears Trans Mountain has addressed most of the CER’s key issues in its new application, RBC Capital Markets analyst Greg Pardy said in a note.

Similarly, a report by analyst Michael Dunn of Stifel said the revised application will likely quell the regulator’s concerns.

“We must wait for the CER to formally respond with its approval,” the Stifel report states.

“However, it looks like the expected startup of TMX . . . should clear what is (hopefully) the final regulatory hurdle.”

Chris Varcoe is a Calgary Herald columnist.

[ad_2]

You can read more of the news on source