[ad_1]

The outgoing chief executive of Canada’s Suncor Energy on Thursday urged the new Alberta government to find a way out of mandatory oil production curtailments that were imposed this year to help boost crude prices.

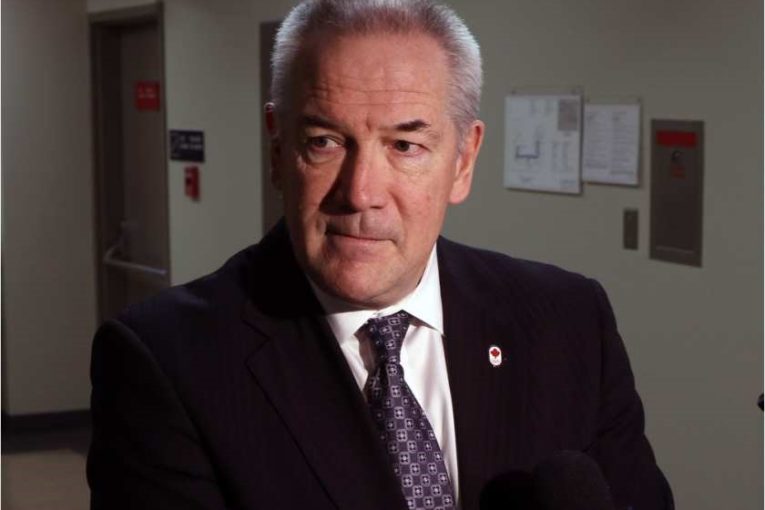

Steve Williams also put Canada’s failure to build new export pipelines that would ship more crude out of landlocked Alberta squarely at the feet of federal and provincial governments and regulators.

Williams will retire next week after 17 years with Canada’s largest energy company by market capitalization, having spent seven of those years at the helm.

His departure coincides with Jason Kenney’s United Conservative Party’s taking power in Alberta, with a promise to aggressively champion the province’s beleaguered energy industry.

Canada is home to the world’s third-largest crude reserves, the bulk of which are in Alberta’s oil sands, but has struggled for years to get new export pipelines built because of regulatory delays and fierce environmental opposition.

Last year Canadian oil prices hit a record discount as pipeline congestion led to a glut of crude building up in Alberta storage tanks, prompting the previous provincial government to impose temporary production cuts effective Jan. 1.

Suncor is an integrated producer whose refineries benefited from being able to buy cheap crude.

“My advice to government is find a managed way to exit this curtailment so the market can start to work again,” Williams said in an interview at Suncor’s headquarters in downtown Calgary.

In the short-term curtailments have boosted prices, but in the medium- and long-term the intervention has made crude-by-rail shipments uneconomic and is deterring investment in the province, he said.

Williams, who will join the board of pipeline company TransCanada Corp after leaving Suncor, said the job of provincial and federal government is to not do anything that could jeopardize much-needed new pipelines’ being built.

“I put the failure of getting pipelines and therefore inward investment firmly in the lap of regulators and government,” Williams said. “Today we have project queued up with investors willing to fund them but frightened by the quagmire they find in Canada.”

He also said it was possible the new Alberta government’s plan to scrap carbon pricing, at a time when investors are putting greater emphasis on the environment, may deter international investment in the oil sands.

During his time in charge, Williams presided over the decision to scrap the C$12 billion Voyageur upgrader project, the sanctioning of the C$17 billion Fort Hills mine and a devastating wildfire in the oil sands hub of Fort McMurray in 2016.

(Reporting by Nia Williams Editing by Leslie Adler)

[ad_2]

You can read more of the news on source